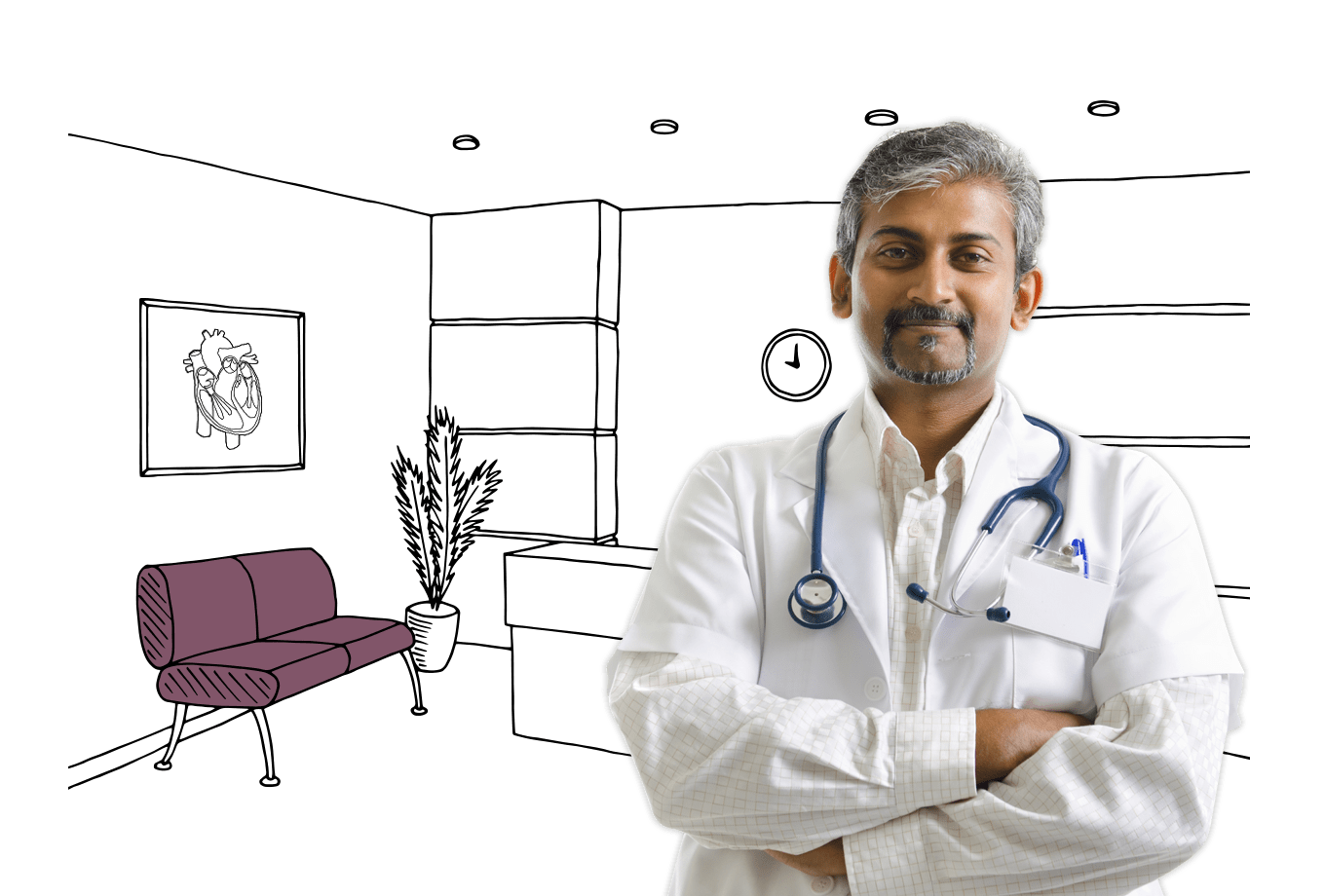

GP & health clinic insurance

When you're in charge of a GP surgery or health clinic it pays to think about protecting your contents and premises from potential damage, as well as your staff and patients. From computers to medical supplies, it's all essential and all potentially costly to replace.